How Inflation Affects Your Homeowner's Policy

A home might be the largest purchase you'll ever make, so you should have the right insurance to protect it. Your homeowner's policy might cover a range of events, including damage from fire and theft. But there's one risk you may be less prepared for: inflation.

Inflation is marked by an overall rise in prices for goods and services over an extended period. As a homeowner, it's important to know how rising prices might affect the cost of repairing or rebuilding your home if you need to file an insurance claim.

Inflation Impacts the Cost of Building

You may feel the most immediate impact of higher prices when paying for things like food or gas. But inflation can send prices for building and construction materials skyrocketing.

As of May 2022, building prices were up 19 percent from the start of the year, according to the Bureau of Labor Statistics. The National Home Builders Association estimates that since the start of the pandemic, building prices are up 35.6 percent overall.

"Inflation and other factors, such as issues with the supply chain, have increased the cost of construction materials at rates we haven't seen in 70 years," says Andrew Latham, a certified financial planner and managing editor of SuperMoney.

Prices for softwood lumber alone have risen 60.4 percent since September 2021. Steel, ready-mix concrete and gypsum products have also seen sizable price increases over the last two years. Those cost increases, along with rises in the cost of construction labor, subsequently get passed on to homeowners.

Homeowner's Insurance May Fall Short When Prices Rise

When you take out a homeowner's policy, certain assumptions are made about the cost of rebuilding should your home be completely destroyed. Inflation can directly affect the cost of rebuilding and just how far your coverage goes.

"If you don't adjust your coverage during periods of inflation, you could find that you don't have enough coverage to repair or rebuild even when your home is damaged by a covered loss," says Latham.

For instance, say your home is destroyed by fire. Your policy covers the cost of rebuilding up to $350,000. Your contractor presents you with an estimated cost to rebuild of $425,000, thanks in part to the higher cost of building materials. That's a $75,000 gap you may have to fill yourself.

Inflation can also affect your homeowner's coverage in a different way if it results in higher premiums. Many insurance carriers build in inflation guards to keep pace with inflation, so customers are likely to see higher-than-average dwelling coverage increases.

"Insurance carriers generally factor in the cost of repairing or rebuilding homes when estimating the premiums they need to charge for providing coverage," says Latham.

Between 2017 and 2021, homeowner's insurance premiums rose 12.2 percent nationwide, according to the Insurance Information Institute. Key drivers of this rate increase include:

- Rising catastrophe losses resulting from severe weather events

- Increasing populations in disaster-prone areas

- Higher costs for construction and building materials

Homeowners who expect this trend to reverse when inflation drops may be disappointed. "Insurance rates tend to be sticky down," says Latham, meaning that prices are likely to rise more easily than they drop.

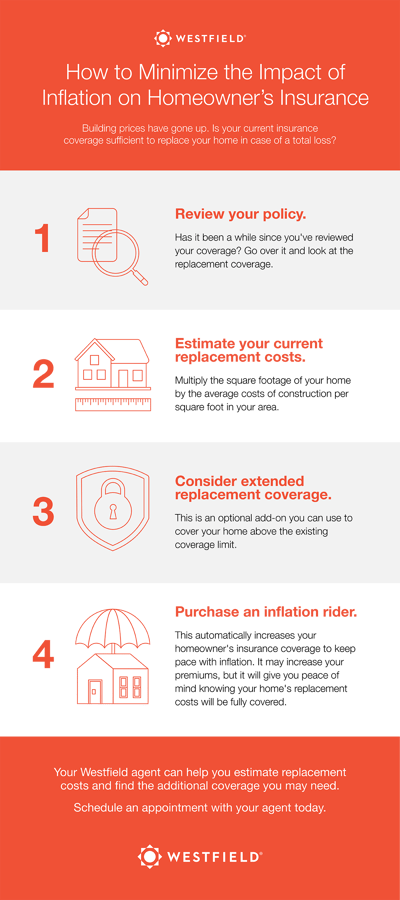

How to Minimize Inflation's Impact on Homeowner's Insurance

If you're concerned about the possibility of having a shortfall in your homeowner's insurance coverage due to inflation, there are some things you can do about it. Here are some strategies for combating rising inflation as a homeowner:

- Review your policy. If it's been a while since you purchased your homeowner's coverage, now may be a good time to pull it out and review it. Specifically, look at the replacement cost the policy pays.

- Estimate your current replacement costs. Figuring out how much it would take to rebuild your home right now can help you identify gaps in your coverage. Latham says you can quickly estimate the replacement cost of your home by multiplying its square footage by the average cost of construction per square foot in your area.

- Consider extended replacement coverage. An extended replacement endorsement is an optional add-on you can use to cover your home above the existing coverage limit.

- Purchase an inflation rider. Inflation guard riders automatically increase your homeowner's insurance coverage to help keep pace with inflation. Similar to extended replacement coverage, adding this rider to your policy may result in higher premium costs. But you may be okay with the trade-off if you'd like the peace of mind knowing your home's replacement costs will be fully covered.

Talking to your insurance agent is a good idea since they can discuss the potential impacts of inflation on rebuilding costs based on the current amount of coverage you have and also make sure coverage for your personal belongings is adequate and covered at replacement cost instead of actual cash value. Your agent can also outline solutions for managing potentially higher rebuilding costs and replacement of personal property if your current policy feels insufficient for your needs.

At Westfield, we offer replacement cost dwelling coverage with our home insurance policies. Use our Find an Agent Tool to locate an agent in your local area who can discuss your options for protecting your home. Click here to download the above infographic.